Conversely, in a downward trend, there is no upper wick on (typically) red candlesticks. In an upward trending market, a Heikin-Ashi chart will show a progression of green (or other coloured) candlesticks with no lower shadow or wick. Reading Heiken-Ashi candles is relatively straightforward, but it is important for investors to understand how they work and what they represent to be able to use them to make informed trading decisions.

#Heikin ashi in metastock pro how to

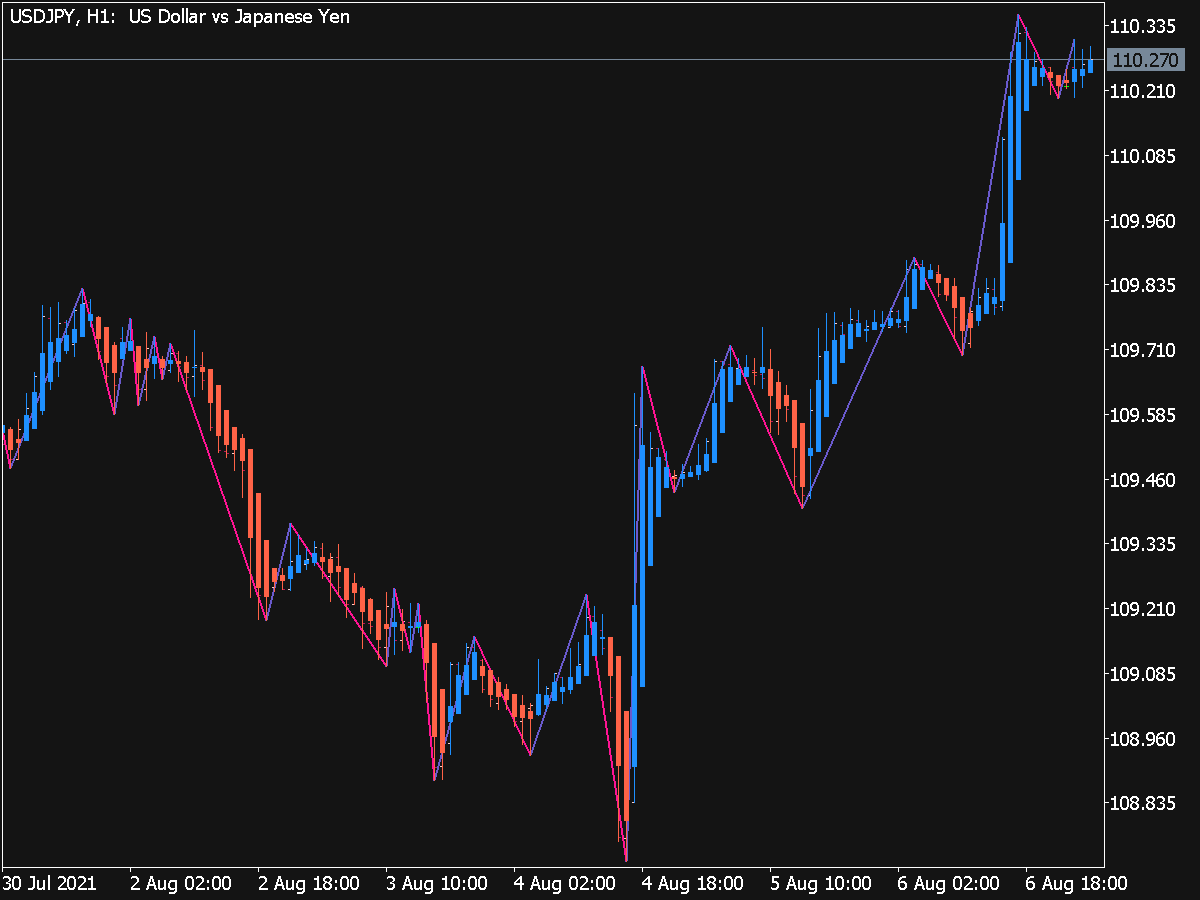

How to interpret Heikin-Ashi candlesticks Traders can use Heikin-Ashi charts to analyse forex and commodities as well as stocks and indices. Combined with other technical indicators they form a fuller picture of the direction of an asset price. The Heikin-Ashi indicators can be applied to any time frame – whether hourly, daily, monthly, etc – although charts showing longer time frames are typically more reliable. Traders can use the charts to identify when to open or hold a trading position and when to exit ahead of a reversal, heavy losses on their investments and avoiding heavy losses. This is especially useful during periods of high volatility, when it can be easy to lose sight of longer-term movements. Why are Heikin-Ashi candlesticks useful for traders?Īnalysis of Heikin-Ashi candles provides a way for traders to identify the start of major price trends and trend reversals by filtering out the day-to-day noise in the stock markets. Understanding the psychology driving price trends put him at an advantage to other traders, as he outlined in his 1755 book, “The Fountain Of Gold: The Three Monkey Record Of Money”. Homma created the first candlestick charts and used them to identify definite trading patterns that formed ahead of changes in the direction of rice prices. He introduced the concept of price action trading based on expectations of bullish or bearish reversals. Homma observed the influence traders’ emotions had on their trading decisions and identified the impact of sentiment on markets driven by fear and greed. The rice market in Osaka at the time operated what could be considered an early version of a futures market using coupons, which were then traded for profit before the rice was physically delivered. Homma is considered by many to be the father of technical analysis for his work in identifying price trends. Heikin-Ashi candles, also sometimes spelled Heiken-Ashi, were developed by Japanese rice trader Munehisa Homma back in the 1700s. Now that we have Heikin-Ashi candles explained, let’s delve deeper into the history. In this way, the Heikin-Ashi calculation creates a smoother-looking candlestick chart that makes it easier to identify and follow price trends.Ī smoother chart is especially useful for analysing choppy or volatile asset prices. Similarly, the low on the wick is the lowest number of the session low, open or close.

The high on the candle wick is the highest number out of the session open, intraday high, or close. The close is an average of the open, high, low and close of the current period, rather than just the closing price. The open price used in a Heikin-Ashi candle is based on the average of the open and close from the previous candlestick. As a result, each Heikin-Ashi candle is lined up with the middle of the preceding bar, not with the level of the previous candle’s close.

This is unlike traditional candlesticks, which use outright open and close prices to form the body of the candle and high and low prices as the shadows, or wicks. The Heikin-Ashi formula uses a combination of four price averages – open, high, low and close values – from the current and previous trading sessions. The candles on these charts differ from traditional Japanese candlestick charts as they incorporate some data from the previous session to show how average values change over time.

A candlestick chart is a type of chart used to visualise price movements and identify patterns, with each candle representing a single trading session.Ī specific form of candlestick chart is Heikin-Ashi, meaning average (“heikin” or “heiken”) and bar (“ashi”) in Japanese. Candlesticks are one of the oldest forms of technical chart indicators that traders can use in their analysis of asset prices.

0 kommentar(er)

0 kommentar(er)